Market Reports

Get a comprehensive look at the real estate market with customized market research. The report also includes a look into the past and what is to come in 2022 and tools to give you a better understanding of todays real estate market.

Market Update | Trends & Quarterly Recap

By: Josh Phillips & Juan Trevino

Although some sources will make it seem like the sky is falling on the real estate market. The honest truth is that we are just witnessing a shift back to some normalcy. The "Unicorn Market" of the last few years has been an eventful and interesting experience that I am sure many agents, homeowners, and investors will talk about for years.

You will hear the word 'recession' over and over again making people, maybe even you, begin to fear that a crash is imminent. Housing statistics from the Northwest Multiple Listing Service (NWMLS) for June and the last few months definitely show signs of a shifting market. However, what is happening now is far from the crash of 2008. What we are seeing is a correction in the market. So what does this mean for you?

For buyers and investors, this market shift is creating opportunities that haven't been always been present in the last few months/years. We are better able to help our clients fight for the best possible outcome on their offers without having to go tens of thousands of dollars over the list price. We are now implementing old strategies we used before 2020 along with new ones that satisfy both buyers and sellers alike.

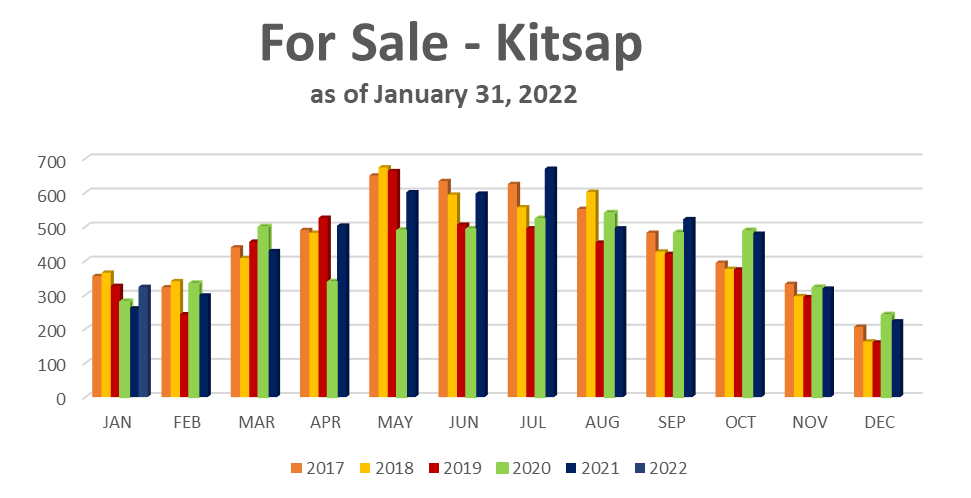

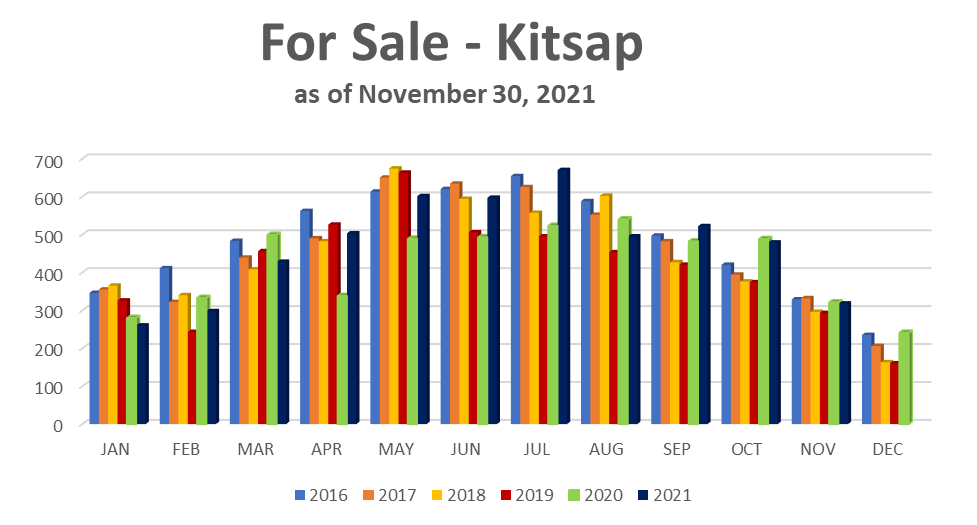

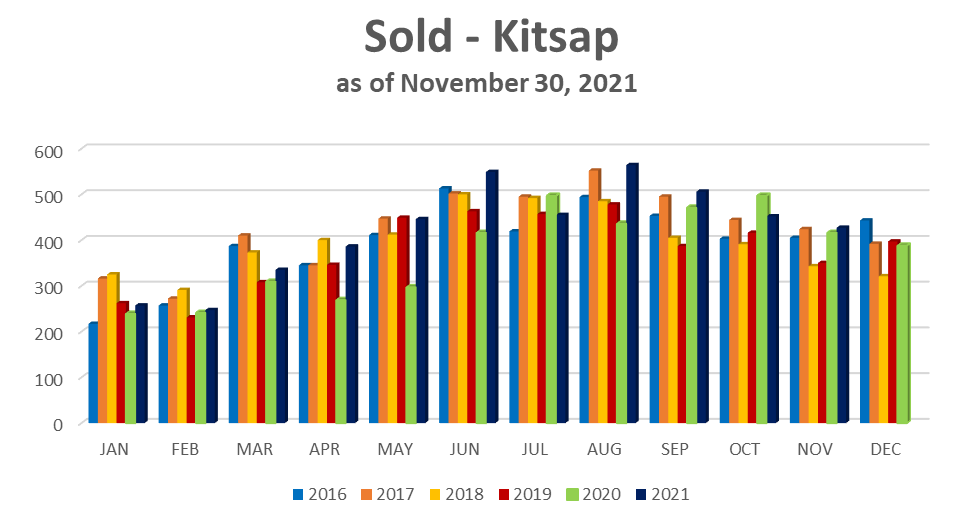

Although interest rates are going up and will likely continue to go up, we are still under the historic average for mortgage rates. There has been a big increase in inventory, and a significant decrease in pending and closed sales. All these changes make buying or investing in a home much less competitive which hopefully means you get the home or asset you really want.

This doesn't mean it is the end of the world for sellers either. We are fortunate that Washington, especially Kitsap and the surrounding counties, stand out among other states and areas. Sellers in our local market are still closing over the average list price in an area that’s median price is much higher than the national average. Although we are seeing an increase in time on market and more houses on the market for buyers to choose from. This gives us a chance to incorporate more of our tried and true marketing strategies and pre-listing preparations that weren't as necessary during this spike in the market over the past few years.

Our client's listings have still been able to perform well by highering the best professionals and contractors in the area. We are paying closer attention to trends, data, and statistics to prepare for any obstacles our clients may face under one of the top real estate offices in the county.

We are learning and tracking more and more every week as we respond to shifts in new behaviors, and market dynamics. So if you have any questions about the market shift and what it may mean for you and your home or properties, please reach out and if we can't help you ourselves we always make sure to connect you with the best resources there are.

Our eyes are on the horizon.

Into the New Year We go - January 2022 Market Recap

By: Josh Phillips & Juan Trevino

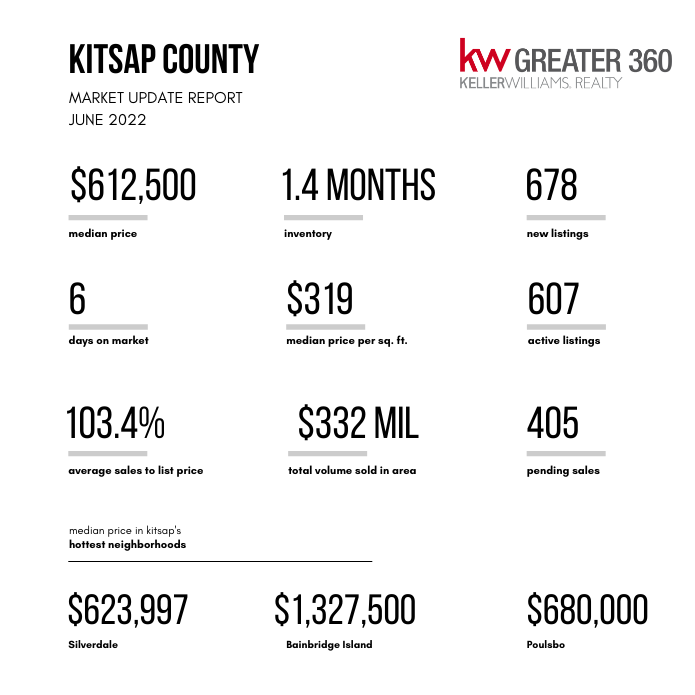

Below is a quick snapshot of what the real estate market looks like as a whole. For most, the value of your home goes beyond just selling it someday. It’s a part of a bigger financial picture. Much like a financial planner periodically sends statements for investment accounts, I want to make sure my friends, family, and clients all know how their home value fits into that bigger plan. This information will be helpful if you’re considering getting a home equity loan, removing Mortgage Insurance from your current loan, completing a 1031 tax exchange, contemplating a move, or simply calculating your current net worth.

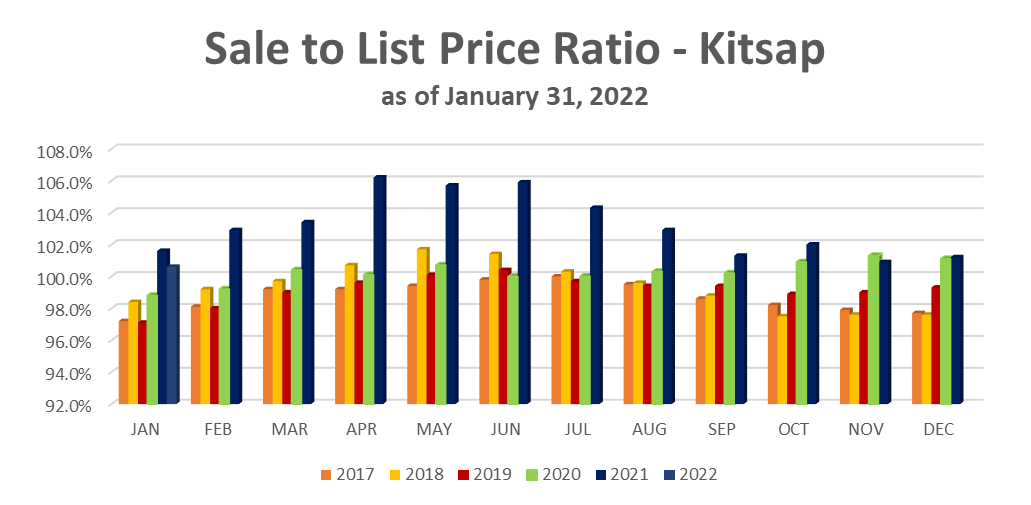

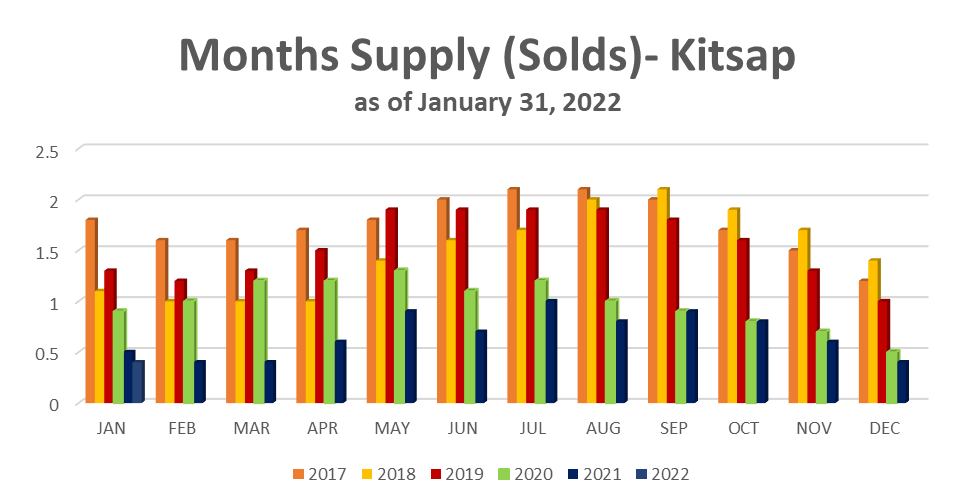

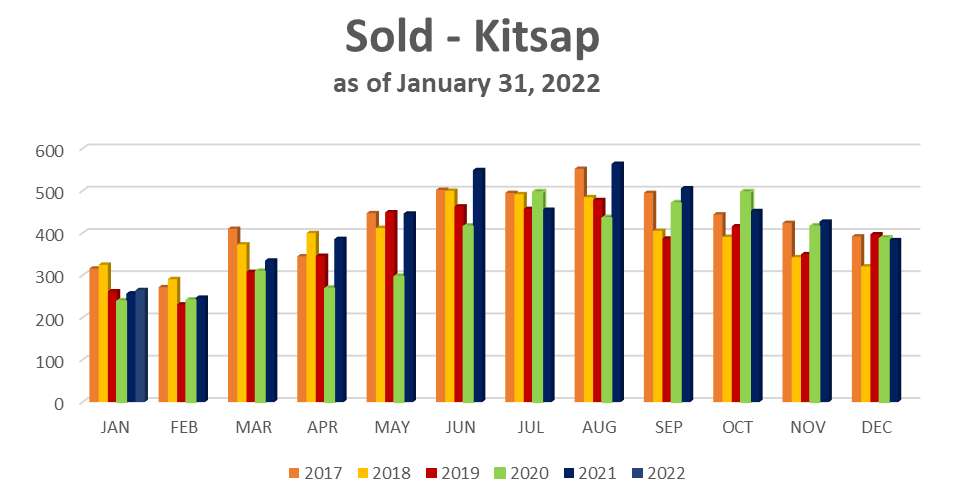

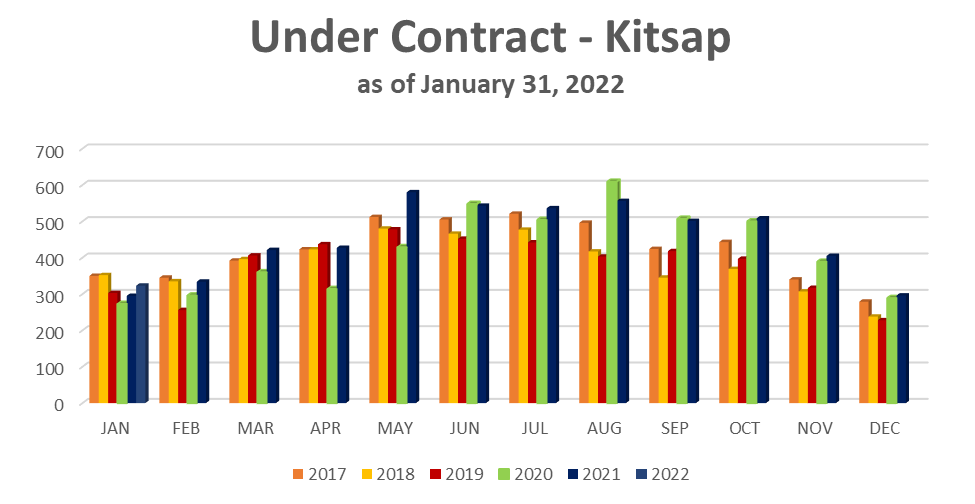

The updated graphs below are a more generic look at the market dynamics. Homes that are priced correctly tend to sell for more than the list price. One of these graphs shows the list price to sold price ratio on a month-to-month basis over the course of the last year. The other shows what the supply of listings has looked like. The term “Months Supply” is a metric we use often. Simply put, the “Months Supply” is how many months it would take for there to be no listings if nothing else were to come on the market.

What the graphs are showing us is that inventory is low and demand is high. This is good news if you own a home in Kitsap.

If you are curious about what your home is worth in today's market. I’d be more than happy to run a full report for you and discuss your options whether you're planning to sell or simply restructure your finances. Let’s get in touch.

2021 Market Report

By: Josh Phillips & Juan Trevino

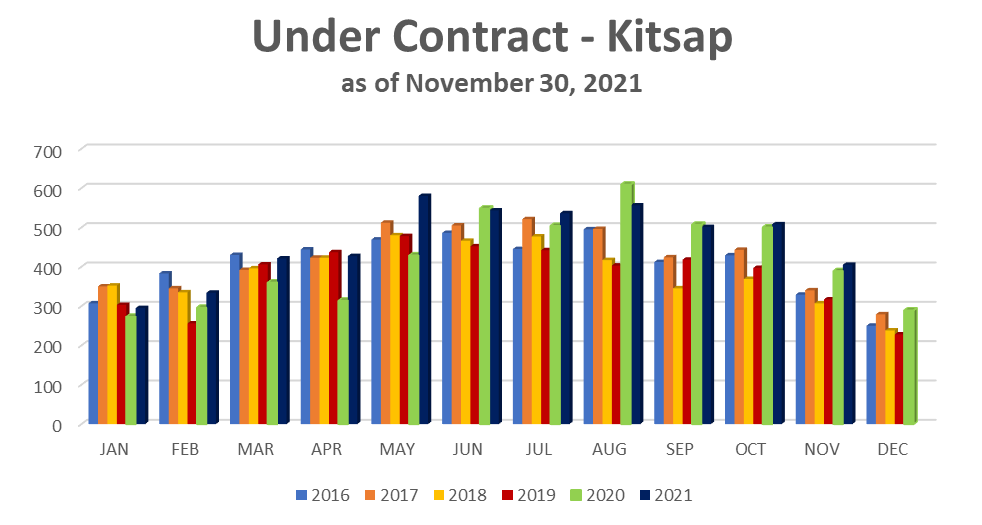

The Puget Sound has been fierce for buyers in 2021 and much the same is expected for the new year. One of the biggest hurdles for buyers is the limited inventory in this area which will likely not change until the spring of 2022. However, according to Evergreen Home Loans it is still expected to be a good year for sellers even though the market will most likely level out over the course of the next 12-18 months. With the limited supply of homes, this may mean mortgage rates rising and higher interest rates; so the end of 2021 is the time for buyers to lock in low monthly mortgage payments for the years to come.

Through the ups and downs of 2021 our team and clients have still had some huge wins! Early this year in January, a client of ours was able to lock in a house of their dreams beating many other offers on a home that SOLD for $1,713,500! Although big numbers are great, we were able to help our clients find their perfect home no matter what their budget was. Our average cost for 2021 was $602,394.74!